in: Financial Management, Accounting, Sage 300 ERP, Sage 300 ERP Tips and Tricks, Sage 300 ERP Tips and Tricks|Software Tips and Tricks, Software Tips and Tricks, Company News

In this tutorial, we will review how to update the 1099 amounts for a vendor. For this scenario, let’s say that after reviewing the 1099 vendor report, we noticed that the amount and code for a certain vendor is incorrect. This can happen if an invoice is keyed incorrectly when originally entered. Thus, we need to update the amount to correct it. Here’s how to do it.

Sage 300 Accounts Payable

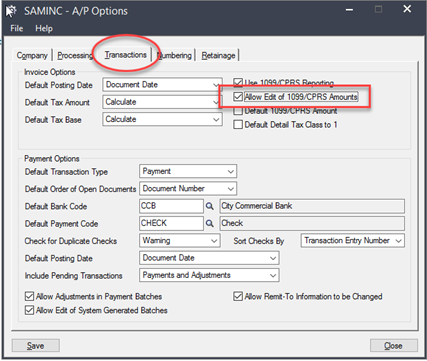

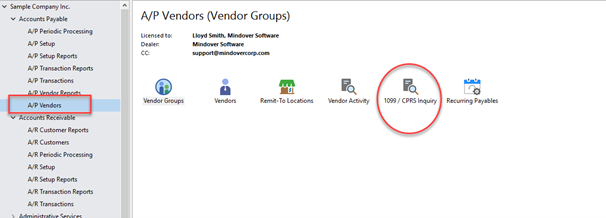

Start by navigating to the Accounts Payable → A/P Setup → Options. First, we want to make sure that the system will allow editing to 1099 amounts.

On the Options screen, click on the Transactions tab. Check the box next to the Allow Edit of 1099/CPRS Amounts. Click Save and then Close.

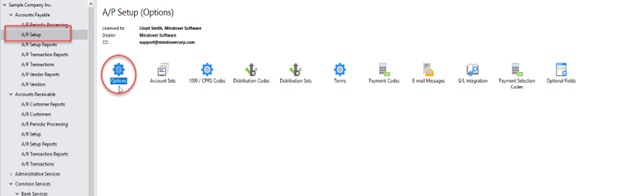

Now, we are ready to update the vendor’s 1099 amount. Go to A/P Vendors and select 1099/CPRS Inquiry.

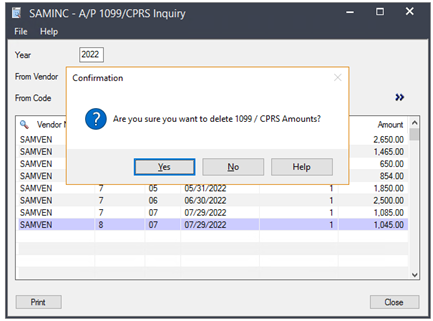

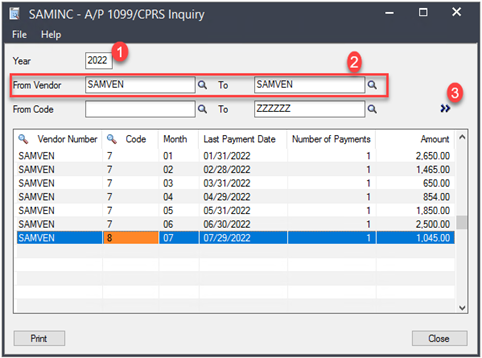

Next, make sure that the correct year is entered. Then, either enter or filter to the appropriate vendor. Hit Search or Go (>>). Notice the miscoded entry and amount in the listed entries.

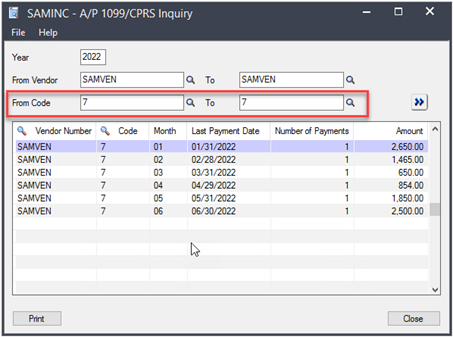

Next, we need to filter ot the correct code. Note that only the correct coded entries are listed.

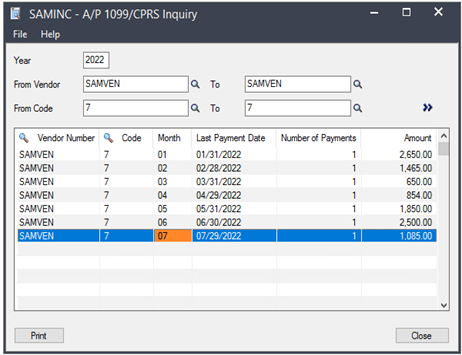

Press the Insert key to add a new line. On the new line, enter the correct detail information into each field. Repeat these steps for each correction/update needed.

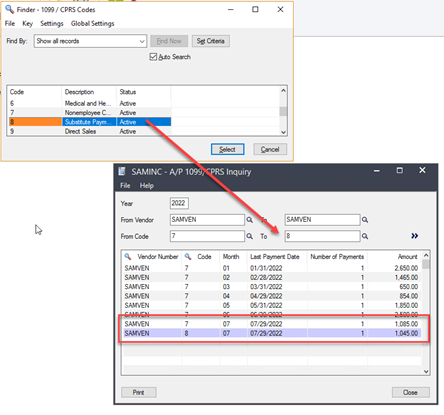

Next, enter or filter to the incorrect 1099 code in the To field. Note the entries differences.

To remove the incorrect entry, simply press the Delete key for each line necessary. Confirm the deletion and close.